Local Authorities are under increasing pressure to improve efficiency, financial oversight, and citizen choice in how they manage self-directed support. The introduction of e-brokerage platforms offers a transformative solution, enabling seamless integration of provider marketplaces, automated payments, and real-time budget management.

This business case outlines the strategic rationale, key benefits, and expected outcomes of adopting an e-brokerage platform as a modern operating system for self-directed support. By replacing fragmented manual processes with a single digital infrastructure, Local Authorities can reduce administrative burdens, enhance market engagement, and ensure citizens have full autonomy over their care arrangements.

The Case for Change

Many Local Authorities face persistent challenges in managing direct payments, individual service funds (ISFs), and commissioned services, including:

- Inefficient, manual administration for brokerage, payments, and provider engagement, leading to delays and high workloads.

- Limited financial oversight, increasing risks of underspending, unspent funds, or financial mismanagement.

- Poor market engagement, making it difficult for citizens to access a diverse and competitive range of providers.

- An over-reliance on traditional commissioning, reducing flexibility and personalisation in care planning.

Without a modern digital infrastructure, Local Authorities will continue to struggle with rising costs, slow processing times, and limited citizen choice in social care.

Proposed Solution: An E-Brokerage Platform as the Operating System

An e-brokerage platform functions as an integrated digital marketplace, allowing Local Authorities to:

- Automate payments and financial oversight, reducing administrative workload and processing errors.

- Connect budget holders with accredited providers, ensuring a competitive and structured marketplace.

- Support both Direct Payments and ISFs, ensuring a consistent, simplified process across different funding mechanisms.

- Enable real-time budget tracking, empowering individuals to manage their care funds efficiently.

- Enhance provider engagement, ensuring small and micro-providers can access the market and citizens have a greater range of support options.

By embedding an e-brokerage platform as a core operating system, Local Authorities can achieve sustainable efficiencies, improved financial oversight, and greater personalisation of care.

Strategic Benefits

For Direct Payment and ISF Recipients

- A user-friendly system for managing care budgets and transactions.

- Greater choice and control, accessing a structured, accredited provider marketplace.

- Faster payments and invoicing, reducing financial stress.

For Care Providers (Including Micro-Providers)

- Automated invoicing and payments, improving cash flow and financial stability.

- Better market access, enabling more providers to compete in a fair, transparent marketplace.

- A more efficient contracting process, reducing administrative overhead.

For Local Authorities and Commissioners

- Substantial time savings for social workers and brokerage officers through process automation.

- Stronger financial oversight, ensuring real-time monitoring of direct payments and ISFs.

- A more dynamic market, allowing providers of all sizes to offer services in an accessible, competitive system.

E-brokerage platforms provide a scalable, long-term solution for modernising self-directed support. By shifting to a fully digital operating system, Local Authorities can streamline workflows, empower citizens, and create a more sustainable care market.

Problem Statement (Generic Version for Any E-Brokerage Platform)

The Current Challenge in Self-Directed Support Management

Local Authorities are responsible for facilitating self-directed support, ensuring that citizens who receive Direct Payments (DPs), Individual Service Funds (ISFs), or commissioned care can access high-quality, cost-effective services. However, existing processes for brokerage, payments, and provider engagement are often disconnected, inefficient, and resource-intensive. These challenges increase costs, delay payments, and reduce citizens’ ability to exercise choice and control over their care.

Key Issues Identified

1. Manual and Inefficient Brokerage and Payment Processes

- Many Local Authorities rely on spreadsheets, email approvals, and disconnected payment systems, leading to delays in processing transactions, approving care arrangements, and tracking budgets.

- Limited integration between brokerage, financial management, and provider engagement results in duplication of effort and inconsistent financial oversight.

- Time-consuming invoice reconciliation processes place a significant burden on social workers, brokerage officers, and finance teams, diverting resources from frontline support.

2. Limited Financial Oversight and Budget Transparency

- Lack of real-time budget tracking makes it difficult for Local Authorities to monitor how direct payments and ISFs are spent, increasing the risk of unspent funds or misallocated budgets.

- Manual invoicing and payment approvals lead to cash flow problems for providers, delayed care arrangements, and potential compliance risks.

- Weak financial monitoring tools increase audit complexity, making it harder to identify potential misuse or inefficiencies in personal budget spending.

3. Poor Market Engagement and Limited Provider Access

- Direct payment holders struggle to find suitable providers, as there is no structured, digital marketplace supporting them in sourcing, contracting, and managing care providers.

- Micro-providers and community-based care services face barriers to entry, limiting service diversity and innovation.

- Lack of real-time provider availability data results in inefficiencies in matching care needs with available support.

4. Heavy Reliance on Traditional Commissioning Models

- Many Local Authorities still depend on block contracts and spot purchasing, which can be costly, rigid, and limit personalisation.

- Social workers and commissioners must intervene frequently to arrange or adjust support packages, increasing workload and administrative overhead.

- Citizens often have limited autonomy, as the current system does not fully support self-directed care at scale.

The Need for Change

To meet the demands of financial sustainability, personalisation, and efficiency, Local Authorities require a modern, automated, and transparent brokerage system that:

- Reduces administrative burden, allowing social workers and brokerage officers to focus on person-centred support rather than financial transactions.

- Provides real-time budget tracking, ensuring direct payments and ISFs are used effectively and transparently.

- Improves provider access, enabling direct payment holders to find and contract accredited providers more easily.

- Enhances market oversight, giving commissioners better data for shaping the local care market.

- Reduces reliance on traditional commissioning, transitioning to a more flexible, demand-driven model that increases choice, competition, and efficiency.

A dedicated e-brokerage platform provides the technological infrastructure to address these challenges, offering a single digital system for managing self-directed support.

Proposed Solution

Overview

To address the inefficiencies and challenges outlined in the Problem Statement, Local Authorities need a modern digital operating system that integrates brokerage, payments, and provider accreditation into a single platform. An e-brokerage platform provides a structured, automated, and transparent system for managing self-directed support, ensuring citizens, social care teams, and providers can operate within a seamless digital environment.

Key Features of an E-Brokerage Platform and How They Address Local Authority Challenges

| Challenge | E-Brokerage Platform Solution |

| Manual and fragmented brokerage and payment processes | – Automates brokerage, invoicing, and payments, reducing reliance on spreadsheets and disconnected systems. – Integrates with finance and case management systems, ensuring seamless data flow. – Provides a centralised digital dashboard for social care teams, improving efficiency. |

| Limited financial oversight and budget tracking | – Enables real-time budget monitoring, reducing unspent funds and financial mismanagement. – Automates financial reconciliation and compliance monitoring, reducing audit risks. – Improves cash flow management by ensuring timely provider payments. |

| Limited access to care providers and market fragmentation | – Creates a structured marketplace where budget holders, brokers, and providers can connect. – Facilitates provider accreditation and service quality monitoring, improving citizen choice. – Encourages micro-providers, ISF brokers, and community-based services to participate, diversifying the market. |

| Over-reliance on traditional commissioning models | – Supports demand-driven, citizen-led purchasing, reducing dependency on block contracts. – Enables flexible care arrangements, allowing individuals to tailor support to their needs. – Encourages a competitive provider market, leading to better pricing and service quality. |

Strategic Benefits of an E-Brokerage Platform for Local Authorities

1. Significant Time Savings for Social Workers and Brokerage Officers

- Reduces manual administration by automating care procurement, invoicing, and payment approvals.

- Frees up social workers to focus on assessments and casework, rather than transactional processes.

- Eliminates duplication in brokerage and financial management workflows.

2. More Efficient Use of Direct Payments and Individual Service Funds

- Ensures that personal budgets are actively managed, reducing underspending and unspent funds.

- Real-time budget tracking allows individuals to use funds more effectively.

- Automated payments and provider contracting eliminate delays and financial disputes.

3. Reduced Administrative Burden and Lower Operational Costs

- Simplifies financial processing, reducing the need for manual intervention.

- Automates provider invoicing and payments, streamlining reconciliation.

- Reduces paperwork and back-office costs, leading to financial efficiencies.

4. Expanded Market and Greater Citizen Choice

- Creates a dynamic marketplace, ensuring direct payment users and ISF holders can access a wider range of providers.

- Encourages new market entrants, including micro-providers and local community organisations.

- Supports local economic growth, making care markets more resilient and competitive.

5. Strengthened Financial Oversight and Compliance

- Automates audit trails and financial reporting, reducing compliance risks.

- Prevents delayed or mismanaged funds, ensuring proper budget utilisation.

- Provides real-time data analytics, helping Local Authorities monitor trends and shape future commissioning.

A Single Operating System for Self-Directed Support

By embedding an e-brokerage platform as the primary operating system for self-directed support, Local Authorities can move from a fragmented, resource-intensive model to a streamlined, efficient, and citizen-led approach. The system’s ability to integrate brokerage, payments, and provider engagement ensures:

- More efficient use of workforce capacity.

- A smoother, more transparent financial process.

- Greater citizen autonomy and provider choice.

- A more sustainable and cost-effective approach to commissioning

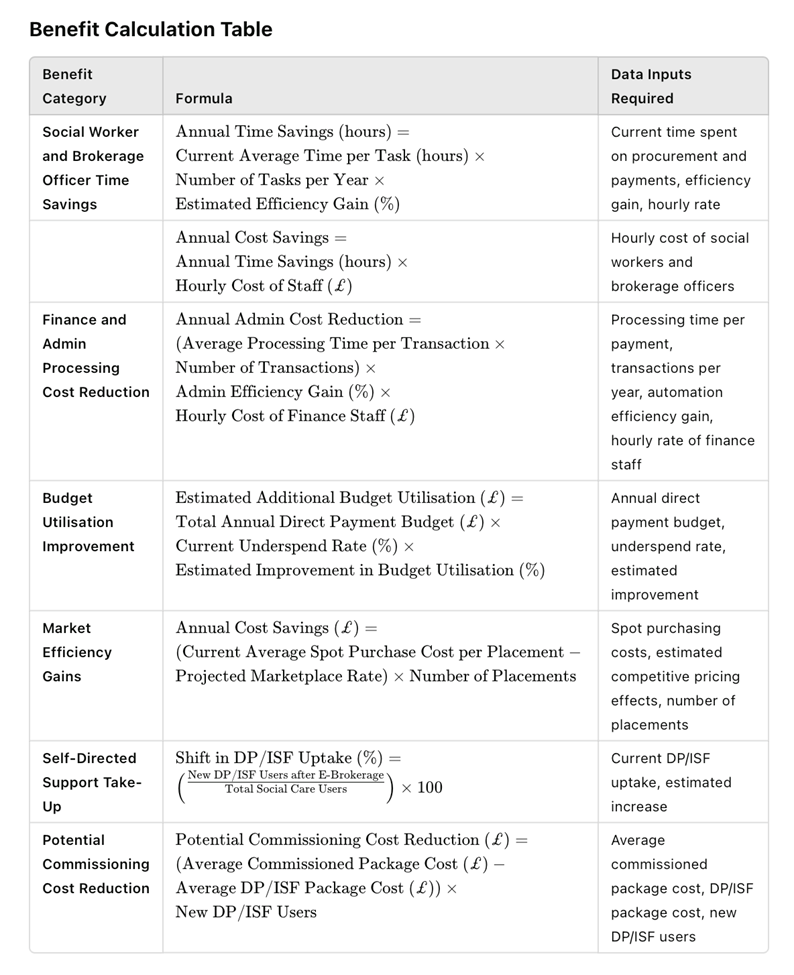

Benefit Calculation Framework

Overview

Local Authorities require a structured approach to quantifying the benefits of implementing an e-brokerage platform without relying on predefined financial projections. This section sets out formulas and methodologies that Local Authorities can use to calculate cost savings, workforce efficiencies, and market impact based on available cost data and time-in-motion studies.

Implementing an e-brokerage platform as a single operating system for self-directed support and brokerage has the potential to revolutionise the way Local Authorities manage and commission care services. This approach:

- Builds upon existing brokerage frameworks, ensuring a more integrated, efficient system.

- Reduces the burden on social workers and brokerage teams, allowing them to focus on person-centred planning rather than financial administration.

- Strengthens financial transparency and budget utilisation, ensuring direct payments and ISFs are managed effectively.

- Encourages market development, enabling a more competitive, flexible, and citizen-driven care market.

- Transitions Local Authorities from a traditional commissioning model to a demand-driven, user-led system, increasing efficiency, cost-effectiveness, and quality of care.

By embedding an e-brokerage platform as a core operating system, Local Authorities can move towards a more sustainable, responsive, and transparent approach to social care, ensuring better outcomes for citizens, providers, and commissioners alike.

Options Appraisal

Local Authorities considering improvements to their self-directed support brokerage, payments, and provider management systems have three primary options:

- Do Nothing – Maintain the Current System

- Partial Implementation – Use an E-Brokerage Platform for Commissioned Services Only

- Full Implementation – An E-Brokerage Platform as a Unified Operating System for All Self-Directed Support

This section evaluates these options based on efficiency, financial oversight, market development, and workforce impact.

Option 1: Do Nothing – Maintain the Current System

Description

- Local Authorities continue using manual processes and disconnected systems for brokerage, payments, and provider engagement.

- Direct payments and ISFs remain managed through separate, non-integrated financial workflows.

- Market engagement remains fragmented, with citizens and providers facing barriers to direct contracting.

Advantages

- No immediate investment required.

- Minimal disruption to existing ways of working.

Disadvantages

- Administrative workload remains high, increasing workforce pressures.

- Financial oversight remains weak, increasing the risk of unspent funds and inefficient budget use.

- Limited provider access for direct payment users, reducing market flexibility.

- Over-reliance on traditional commissioning, limiting citizen choice and control.

Risk Assessment

- High risk of continued inefficiencies and unsustainable service delivery.

- Increased workforce pressure, leading to potential recruitment and retention challenges.

- Escalating costs due to inefficiencies in financial processing and brokerage.

Option 2: Partial Implementation – Use an E-Brokerage Platform for Commissioned Services Only

Description

- An e-brokerage platform is implemented as a brokerage and payments tool for commissioned services, but not extended to direct payment or ISF users.

- Brokerage teams and providers use the platform to manage contract payments and invoicing.

- Citizens still manage direct payments manually, limiting full system efficiency.

Advantages

- Reduces administrative burden for brokerage teams managing commissioned services.

- Improves financial transparency for commissioned contracts.

- Provides a structured platform for provider accreditation and contract management.

- Lower initial investment compared to full implementation.

Disadvantages

- Direct payment and ISF users remain outside the system, sustaining inefficiencies.

- No impact on self-directed support take-up, meaning individuals still struggle with provider selection.

- Market remains fragmented, as commissioned services are digitalised while personal budgets remain manually managed.

- Limited impact on social worker workload, as direct payment processes remain unchanged.

Risk Assessment

- Medium risk of sustaining inefficiencies in self-directed support.

- Some cost savings for commissioned services, but limited financial oversight for personal budgets.

- Market remains difficult to shape, as only part of the provider network is included in the system.

Option 3: Full Implementation – An E-Brokerage Platform as a Unified Operating System

Description

- The e-brokerage platform is implemented as the primary brokerage and payments system for all self-directed support, including commissioned services, direct payments, and ISFs.

- Personal budget holders and brokers gain access to the same accredited provider marketplace as brokerage teams, ensuring a cohesive and fully integrated system.

- Payments, invoicing, and financial oversight are fully automated, reducing workload for social workers, brokerage officers, and finance teams.

Advantages

- Substantial time savings for social workers and brokerage teams.

- Direct payment and ISF users gain full access to an accredited provider network, improving choice and quality.

- Market shaping improves, as all providers – commissioned and self-directed—are visible within a single platform.

- Reduces reliance on traditional commissioning, increasing flexibility and efficiency.

- Ensures real-time financial oversight, reducing risks of fraud, unspent funds, and payment delays.

Disadvantages

- Higher initial investment to integrate all services into the platform.

- More extensive system implementation, requiring staff training and process realignment.

Risk Assessment

- Low risk of inefficiencies, as most processes are automated and streamlined.

- Higher upfront costs, but greater long-term savings through workforce efficiency and financial control.

- Improved workforce retention, as social workers and brokerage officers focus on person-centred support instead of administration.

Comparative Evaluation

| Criteria | Option 1: Do Nothing | Option 2: Partial Implementation | Option 3: Full Implementation |

| Impact on Social Worker and Brokerage Officer Time | No improvement | Reduces admin burden for brokerage teams only | Significant reduction in workload across teams |

| Financial Oversight and Budget Control | Limited tracking of direct payments and ISFs | Improved oversight for commissioned services only | Full financial transparency and automated tracking |

| Self-Directed Support Take-up | No increase | No major impact | Significant increase, as citizens access the same provider network as commissioned services |

| Market Shaping and Provider Engagement | Fragmented | Commissioned services improved, but DP/ISF market remains disjointed | Full market integration, increasing provider competition and service quality |

| Administrative Cost Savings | None | Partial savings | Significant savings through process automation |

| Long-Term Sustainability | High risk of continued inefficiencies | Some efficiency gains but limited impact on personal budgets | Future-proof system that supports self-directed support growth |

Preferred Option – Full Implementation of an E-Brokerage Platform

The full implementation of an e-brokerage platform as the single operating system for commissioned services, direct payments, and ISFs offers the greatest strategic benefits to Local Authorities.

- Reduces administrative workload for social workers and brokerage officers.

- Empowers direct payment users to access an accredited provider network, improving service quality and flexibility.

- Enables a data-driven, citizen-led model of care procurement, moving away from manual commissioning processes.

- Ensures financial transparency and accountability, reducing risks of unspent funds and inefficient spending.

By implementing an e-brokerage platform across all self-directed support functions, Local Authorities can transition to a sustainable, demand-led model, ensuring long-term efficiency, financial sustainability, and improved citizen outcomes.

Additional Benefits for Citizens: Choice, Control, and Support in Managing Budgets

The implementation of an e-brokerage platform not only improves efficiency for Local Authorities and providers but also delivers significant benefits for citizens using Direct Payments (DPs) and Individual Service Funds (ISFs). By providing better tools for budget management, provider access, and brokerage support, the system enhances choice, control, and flexibility in self-directed care.

Key Benefits for Citizens

1. Greater Choice and Control Over Support

- Citizens can directly access a structured provider marketplace, allowing them to compare services, costs, and availability in one place.

- The ability to browse accredited providers means individuals can select care that best meets their cultural, personal, and practical needs.

- No reliance on outdated lists or limited networks—citizens can explore both traditional and non-traditional providers, including personal assistants, micro-providers, and community services.

2. Easy-to-Use Budget Management Tools

- The platform provides real-time tracking of care budgets, helping individuals and families monitor spending, remaining funds, and forecasted costs.

- Automated payments and invoicing eliminate the need for manual tracking, reducing stress for citizens managing their care budgets.

- Citizens can see how much of their budget has been used, ensuring funds are spent effectively and efficiently.

3. Access to Local Authority-Accredited Providers

- Citizens can access Local Authority-approved providers, ensuring quality, safety, and regulatory compliance while still retaining personal choice.

- A mix of commissioned and independent providers is available, offering citizens greater flexibility in how they arrange support.

- The system provides a level playing field for all providers, ensuring that small and community-based services are visible and accessible.

4. Brokerage Support for Direct Payments and ISFs

- Not all citizens feel confident managing their own support—an e-brokerage platform allows individuals to work with brokers to arrange services on their behalf while still maintaining choice and control.

- Social workers, family members, and independent brokers can support the procurement of care without handling complex financial transactions.

- This ensures those who need assistance with decision-making can still benefit from self-directed support without being left to navigate the system alone.

Conclusion: A Citizen-Centred Approach to Self-Directed Support

An e-brokerage platform creates a truly citizen-led care system, where individuals have:

- More choice over how their support is delivered.

- Greater transparency in spending and budget management.

- Better access to accredited providers, micro-providers, and community-based services.

- Support in managing direct payments and ISFs through brokerage assistance.

By embedding an e-brokerage platform as the core infrastructure for self-directed support, Local Authorities can ensure that citizens receive the benefits of personalisation without the administrative burden, leading to better outcomes, increased independence, and improved.

Chris Watson

Chris Watson is the founder of Self Directed Futures, the Chair of SDS Network England and co-founder of LDA Commissioners Network. With extensive experience in strategic commissioning and change management, Chris advocates for innovative, community-led approaches to adult social care.